Offshore investment solutions.

Innovative global solutions to meet the needs of South African investors.

With the updates to South Africa’s retirement fund regulations, collaborating with the right investment partner has never been more important.

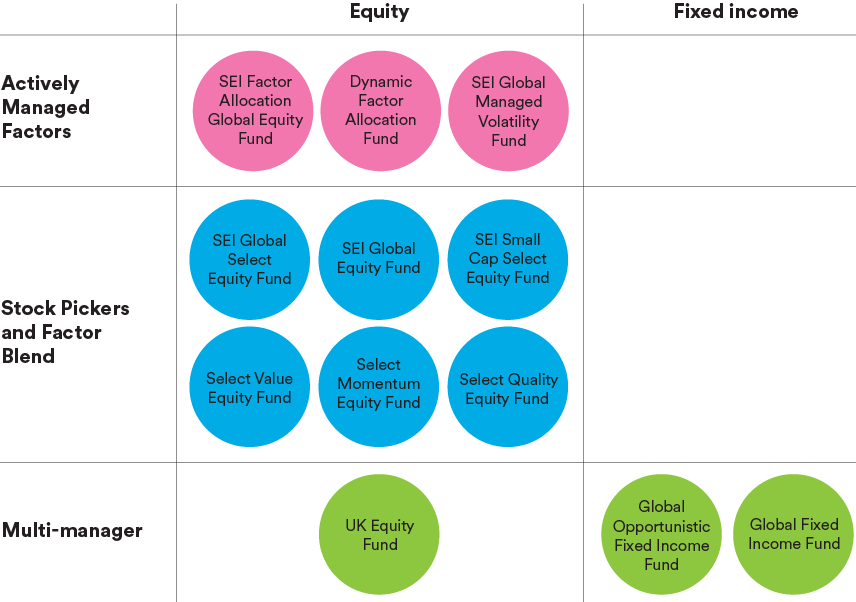

Our offering seamlessly combines a local presence with the size, stability, and reach of SEI as a global brand, providing exposure to investment sectors that might otherwise be inaccessible to South African investors.

25+

years' experience serving South African investors

$1.7T

AUM/AUA globally*

B-BBEE

one of few offshore managers with a local accreditation

*Source: SEI, as at 30 June 2025.

Why SEI?

For over 25 years, we’ve been building actively managed solutions to help South African investors meet their objectives.

What makes us different?

Our position within the South African market is somewhat unique.

Broad-Based Black Economic Empowerment (B-BBEE) accreditation: Level 3 Contributor

With B-BBEE accreditation today a requirement for many public retirement funds, we’re proud to have achieved Level 3 Contributor status. Very few offshore managers have a local presence, let alone B-BBEE accreditation.

Local presence, global reach

We’ve been committed to the South African market for decades, having opened an office in Johannesburg in 1995. We also provide exposure to investment sectors that might otherwise be inaccessible to South African investors.

A commitment to sustainable investing

As a signatory to the Principles for Responsible Investing (PRI), we are committed to enhancing our approach to sustainable investing. To ensure ESG and sustainability factors are considered in portfolio management, we:

- Perform an ESG assessment as part of manager research to develop a deeper understanding of managers’ capabilities

- Require that all managers consider material financial and non-financial risks as part of their investment process

- Conduct effective and independent risk oversight

- Strive to act as good stewards of assets through shareholder engagement and proxy voting

Announcements

SEI’s Institutional Group Names Santoshi Jugmohun Managing Director

SEI Provides Equity Stake in South African Business to South African Employees

B-BBEE is an integral part of our business operations.

SEI Investments (South Africa) (Pty) Ltd has been independently rated by Amax BEE Verifications as a Level 3 Contributor to B-BBEE as of 3 March 2025.

Offshore investment management specialists.

Global solutions designed to meet the needs of South African investors.

Important information

This is a marketing communication.

The material on this page is provided for informational purposes only, for intended recipients who are professional investors, but is not directed at, or intended for distribution or publication to or use by, any person or entity who is a citizen or resident of or located in any jurisdiction where such direction, distribution, publication or use would be contrary to applicable law or regulation or which would subject SEI Investments (South Africa) (Pty) Limited (“SISAL”) to any additional registration or licensing requirements with such jurisdiction.

Nothing contained on this page constitutes tax, legal, insurance or investment advice. Neither the information, nor any opinion, contained on this page constitutes a solicitation or offer by SISAL to buy or sell any securities, futures, options or other financial instruments, nor shall any such security be offered or sold to any person in any jurisdiction in which such offer, solicitation, purchase, or sale would be unlawful under the securities laws of such jurisdiction. Decisions based on information contained on this Webpage are the sole responsibility of the visitor. In exchange for using this Webpage, the visitor agrees to indemnify and hold SISAL, its officers, directors, employees, affiliates, agents, licensors and suppliers harmless against any and all claims, losses, liability, costs and expenses (including but not limited to attorneys' fees) arising from your use of this page, from your violation of these Terms or from any decisions that the visitor makes based on such information.

This information is issued in South Africa by SEI Investments (South Africa) (Pty) Limited FSP No. 13186 which is a financial services provider authorised and regulated by the Financial Sector Conduct Authority (FSCA). Registered office: 3 Melrose Boulevard, 1st Floor, Melrose Arch 2196, Johannesburg, South Africa.

A number of sub-funds of the SEI Global Master Fund plc and the SEI Global Investment Fund plc (the “SEI UCITS Funds”) have been approved for distribution in South Africa under s.65 of the Collective Investment Schemes Control Act 2002 as foreign collective investment schemes in securities. If you are unsure at any time as to whether or not a portfolio of SEI is approved by the Financial Sector Conduct Authority (“FSCA”) for distribution in South Africa, please consult the FSCA’s website (www.fsca.co.za).

This material is not directed to any persons where (by reason of that person’s nationality, residence or otherwise) the publication or availability of this material is prohibited. Persons in respect of whom such prohibitions apply must not rely on this information in any respect whatsoever. Investment in the funds or products described herein are available only to intended recipients and this communication must not be relied or acted upon by anyone who is not an intended recipient.

While considerable care has been taken to ensure the information contained within this document is accurate and up-to-date, no warranty is given as to the accuracy or completeness of any information and no liability is accepted for any errors or omissions in such information or any action taken on the basis of this information.

Collective Investment Schemes (CIS) are generally medium to long term investments and investors may not get back the full amount invested. The value of participatory interests or the investment may go down as well as up and past performance is not a reliable indicator of future results. SEI does not provide any guarantee either with respect to the capital or the return of an SEI UCITS Fund. The SEI UCITS Funds are traded at ruling prices and can engage in borrowing and scrip lending. A schedule of fees and charges and maximum commissions is available upon request from SEI. The SEI UCITS Funds invest in foreign securities. Please note that such investments may be accompanied by additional risks such as: potential constraints on liquidity and the repatriation of funds; macroeconomic, political/emerging markets, foreign currency risks, tax and settlement risks; and limits on the availability of market information. The UCITS may be de-registered for sale in an EEA jurisdiction in accordance with the provisions of the UCITS Directive. For full details of all of the risks applicable to the SEI funds, please refer to the Risks highlighted in the relevant fund prospectus.

This webpage is intended for information purposes only and the information in it does not constitute financial advice as contemplated in terms of the Financial Advisory and Intermediary Services Act.