Not all value ETFs are created equal: SEIV’s approach to value investing.

Written by: Robert Hum, CAIA.

Not all value ETFs are created equal: SEIV’s approach to value investing

Value investing has long been a cornerstone of portfolio construction—but traditional approaches often fall short in today’s dynamic markets. While it’s been challenging for value in this recent environment, the SEI Enhanced US Large Cap Value Factor ETF (SEIV) has delivered strong relative outperformance over the past three years. SEI’s Quantitative Investment Management (QIM) team elevates value investing through rigorous research and practical implementation.

See SEIV’s performance as of most recent calendar quarter and month-end.

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor's shares, when redeemed, may be worth more or less than their original cost, and current performance may be lower or higher than the performance quoted. Expense Ratio: 0.15%.

In my previous post, I shared why SEI’s approach—thoughtful construction, active factor management, and global reach—was a key reason I joined SEI. Now, let’s explore how this philosophy drives the SEI Enhanced US Large Cap Value Factor ETF. And if you’re thinking, “it must be style drift,” keep reading.

Taking a multi-factor lens to value investing.

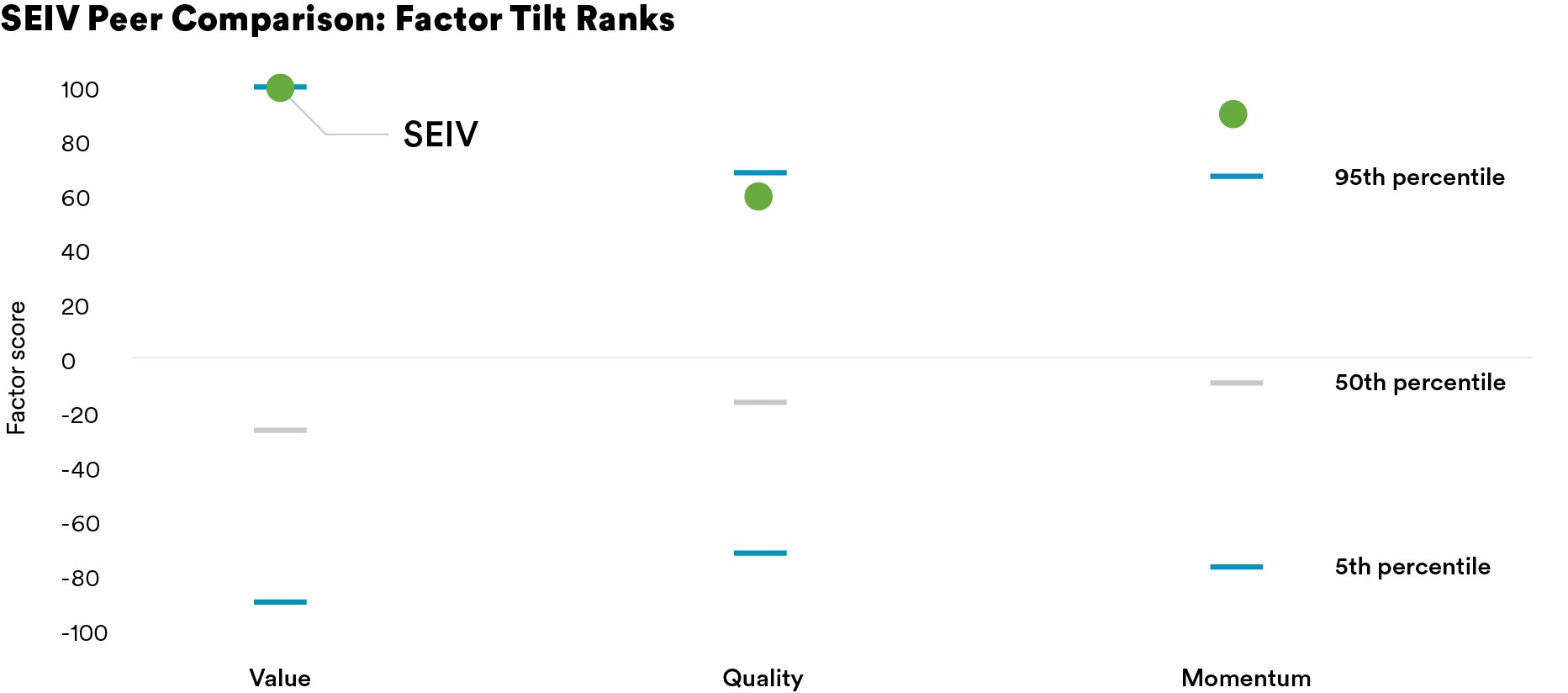

You might be thinking: “This has to be a growth fund in value clothing.” Not at all. SEIV is firmly rooted in value, but it’s designed to avoid classic value traps by layering in Quality and Momentum Factors. Our approach doesn’t just rely on traditional value measures like book-to-price, but it diversifies across how we define value and further diversifies across multiple factors to strengthen the portfolio’s resilience.

Source: Morningstar as of 12/31/25. Percentile ranking compares the 1,150 large-cap value ETFs and mutual funds with over a 3-year performance track record. The value ranking is measured by each fund’s price-to-earnings ratio (P/E), momentum ranking is measured by each fund’s momentum score defined by Morningstar and quality ranking is defined by each fund’s return-on-equity (ROE).

In fact, as shown above, SEIV ranks near the top of its peer group across value and momentum tilts. Its strong value orientation, paired with positive momentum and solid fundamentals relative to deeper value strategies, creates a distinctive profile.

Managing traditional value sector bets.

SEIV takes a disciplined, risk-managed approach to portfolio construction, balancing return potential with careful risk management, such as tracking error, idiosyncratic risk, and sector exposures. Unlike traditional value indexes that often make large sector bets, SEIV is sector-aware relative to the broad market.

For example, unlike many value benchmarks that are over 20% underweight technology, SEIV is only about 3% underweight—and trades at just 11.1 times earnings, a substantial 50% discount to the Russell 1000’s 22.4 times earnings1. This underscores the fund’s deep value orientation, even with significant exposure to technology. Within sectors like technology, we identify companies with the most attractive relative valuations, combined with strong quality and momentum factors—ensuring that exposure is both diversified and aligned with our multi-factor approach. This thoughtful positioning helps maintain diversification and reduce unintended risks while staying true to its value mandate.

Human insight meets technology.

We believe the best results come from blending innovation with experience. Our process doesn’t rely on algorithms alone. Instead, we combine advanced technology with human judgment to deliver thoughtful, risk-aware decisions. Every trade recommendation generated by our models is reviewed by seasoned portfolio managers to ensure alignment with the strategy’s objectives and long-term goals.

Final thoughts.

With a five-star Overall Morningstar rating* and $1 billion in assets under management, SEIV exemplifies active management with a disciplined, adaptive approach. Rather than sticking to rigid style classifications, SEIV dynamically adjusts to evolving market conditions while maintaining a consistent, risk-conscious framework.

*Morningstar Direct as of 12/31/25. Universe includes 1,107 funds in the Morningstar U.S. Fund Large Cap Value Category based on risk adjusted returns.

And here’s what truly sets SEIV apart: an expense ratio of just 15 basis points, making it one of the lowest-cost actively managed value fund ETF in the industry. Investors get the best of both worlds—active oversight and cost efficiency—without compromising quality.

Ready to take the next step?

Reach out to your SEI team to see how SEIV can be implemented in your clients’ portfolios.

Explore more resources on factor investing

See our financial term and index definitions

Important information

1Seeking Alpha. SEIV: Deep Value, Differentiated Sector Mix. Data as of 9/30/2025.

SEI Investments Management Corporation (SIMC) is the adviser to the SEI Funds, which are distributed by SEI Investments Distribution Co. (SIDCo.) SIMC and SIDCo are wholly owned subsidiaries of SEI Investments Company. For those SEI Funds which employ the 'manager of mangers' structure, SIMC has ultimate responsibility for the investment performance of the Fund due to its responsibility to oversee the sub‐advisers and recommend their hiring, termination, and replacement. SEI’s Quantitative Investment Management (QIM) is a team within SIMC.

To determine if the Fund is an appropriate investment for you, carefully consider the investment objectives, risk factors and charges, and expenses before investing. This and other information can be found in the Fund's full or summary prospectus, which can be obtained by calling 1‐800‐DIAL‐SEI. Read the prospectus carefully before investing.

There are risks involved with investing including loss of principal. There can be no assurance that performance will be enhanced or risk will be reduced for investment strategies that seek to provide exposure to certain quantitative factors. Exposure to such investment factors may detract from performance in certain market environments, in some cases for extended periods. In such circumstances, an investment strategy may seek to maintain exposure to the targeted investment factors and not adjust to target different factors, which could result in losses.

While the investment strategies are actively managed, the strategies’ investment process is expected to be heavily dependent on quantitative models and the models may not perform as intended.

This information is based on the views of, and provided by, SEI Investments Management Corporation (SIMC), a registered investment adviser and wholly owned subsidiary of SEI Investments Company. This information should not be relied upon by the reader as research or investment advice or recommendations (unless SIMC has otherwise separately entered into a written agreement for the provision of investment advice regarding the subject matter of this material).

The Morningstar RatingTM for funds, or "star rating", is calculated for managed products (including mutual funds, variable annuity and variable life subaccounts, exchange-traded funds, closed-end funds, and separate accounts) with at least a three-year history. Exchange-traded funds and open-ended mutual funds are considered a single population for comparative purposes. It is calculated based on a Morningstar Risk-Adjusted Return measure that accounts for variation in a managed product's monthly excess performance, placing more emphasis on downward variations and rewarding consistent performance. The Morningstar Rating does not include any adjustment for sales load. The top 10% of products in each product category receive 5 stars, the next 22.5% receive 4 stars, the next 35% receive 3 stars, the next 22.5% receive 2 stars, and the bottom 10% receive 1 star. The Overall Morningstar Rating for a managed product is derived from a weighted average of the performance figures associated with its three-, five-, and 10-year (if applicable) Morningstar Rating metrics. The weights are: 100% three- year rating for 36-59 months of total returns, 60% five-year rating/40% three-year rating for 60-119 months of total returns, and 50% 10-year rating/30% five-year rating/20% three-year rating for 120 or more months of total returns. While the 10-year overall star rating formula seems to give the most weight to the 10-year period, the most recent three-year period actually has the greatest impact because it is included in all three rating periods.

The SEI Enhanced US Large Cap Value Factor ETF (SEIV) was rated five stars out of 1,107 Large Cap Value Funds as of 12/31/25.