The diversification illusion

SEI DC Think Tank

An economic regime change may be afoot.

Correlation between asset classes can be highly dependent on the macroeconomic regime.

Over the past two decades, returns from equities and bonds have exhibited a weakly inverse correlation (i.e., when one rose, the other fell). For defined contribution (DC) members entering the retirement phase, this has helped offset losses and smooth overall returns, particularly during periods of equity market stress.

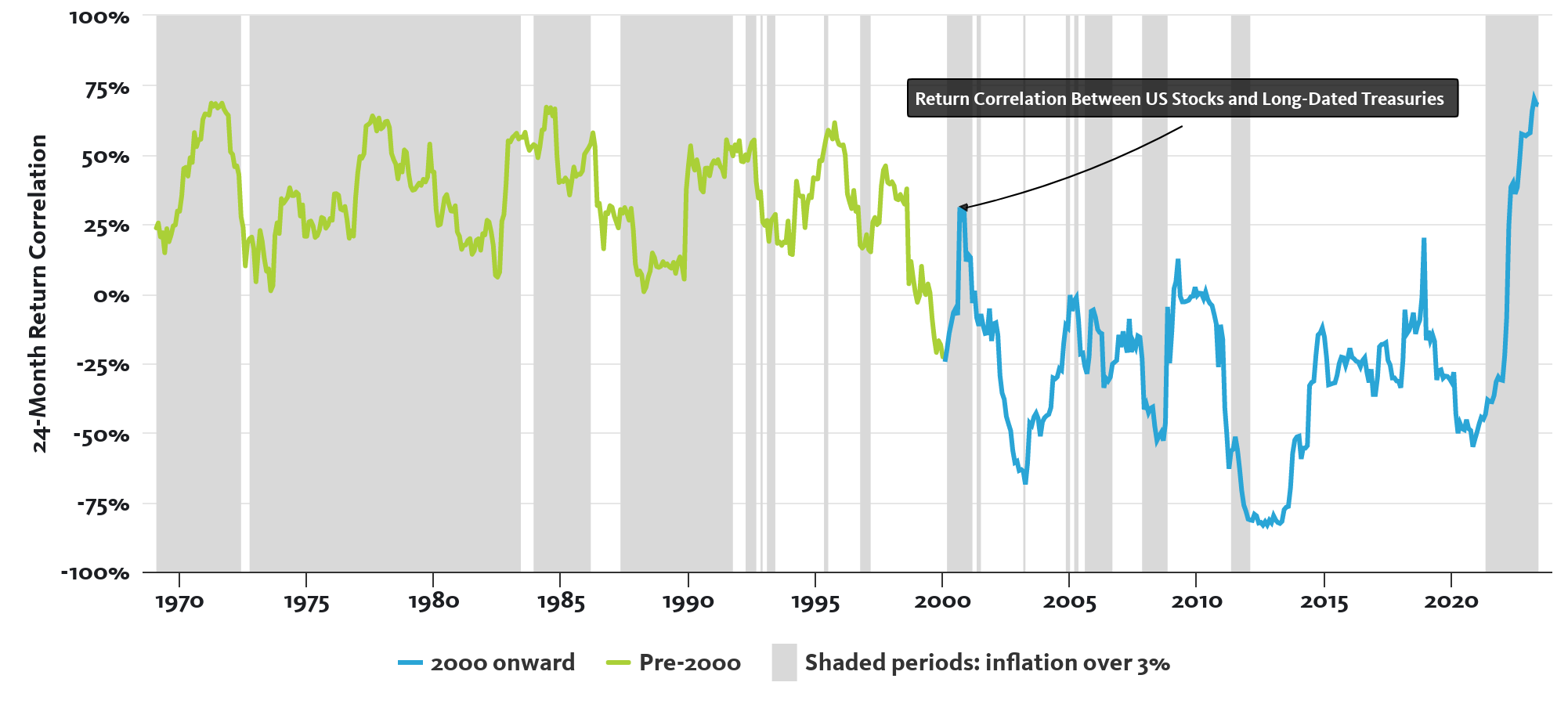

However, from early 2022, this has not been the case as stocks and bonds have instead become positively correlated (i.e., when one rose, the other rose and vice versa), as shown in the chart below. This reversal has coincided with a continuing episode of elevated inflation across the developed world. Demographics, global supply chain rebalances, and geopolitical tensions are among the fundamental and structural factors that we believe can cause this inflation regime to remain more persistent than expected over the medium term. For investment strategies, the positive correlation between stocks and bonds erodes their potential diversification benefit and introduces risk.

Source: SEI, Bloomberg. Stocks represent the U.S. dollar return on the Center for Research in Security Prices U.S. Total Stock Market Index. Bonds represent the U.S. dollar returns of the ICE Bank of America 10+ Year U.S. Treasury Index from January 1987 onwards, and prior to that returns derived from the Composite Yield on U.S. Treasury Bonds with Maturity over 10 Years Index provided by the Federal Reserve Bank of St. Louis. CPI inflation is the consumer price index for all urban consumers: All Items in U.S. City Average from the Federal Reserve Bank of St. Louis. Past performance does not predict future returns. Index returns are for illustrative purposes only and do not represent actual fund performance. Index performance returns do not reflect any management fees, transaction costs, or expenses. Indices are unmanaged and one cannot invest directly in an index.

What does this mean for a DC member?

For members who were at the retirement phase of their journey in 2022, the negative impact of stocks and bonds falling together proved particularly challenging.

The latest Corporate Adviser Intelligence report on master trusts and GPPs1 found that through 2022, the average one-year return for a member one day from state pension age was -8.05%. However, the most extreme loss experienced in this survey was -17.1%. As the report identifies, when double-digit inflation figures are factored in, the real impact to retirement fortunes becomes significant for members pursuing drawdown.

It is highly unlikely that a member will be able to recoup losses of this magnitude at this stage of the retirement journey.

Taking a step back, most UK master trust default strategies have been designed and constructed during the period of negative stock-bond correlation. A typical stock-bond portfolio tends to benefit from low or falling inflation and steady economic growth, economic conditions that seem a far cry from where we are today. It is likely that investors have taken the historical diversification between stocks and bonds for granted, given the long period of low inflation experienced since 2009.

Given this potential shift in economic regime, we believe the resilience of some of these strategies could come under question, particularly those overly reliant on diversification between stocks and bonds, and that bonds are always low risk. Therefore, strategies that utilise traditional methodologies may be exposing themselves to a lower diversification benefit than expected. To add to that, asset classes previously considered “safe havens”, such as UK government bonds, have proved to be more volatile than expected.

Consideration needs to be given to strategic asset allocation and glidepath implementation to maximise portfolio resiliency through retirement. A thoughtful, forward-looking approach to asset allocation is likely to deliver better outcomes to retirees, rather than an approach overly reliant on backward-looking assumptions rooted in historical asset class returns.

1“Master Trust and GPP Defaults Report,” Corporate Adviser Intelligence, April 2023.

How do we mitigate these risks?

We have identified three key areas to consider:

Diversification

Whilst the diversification benefit of holding stocks and bonds has been eroded since early 2022, it remains a critical component of risk management. We take a conservative approach when estimating asset class correlations. When stress testing, if the correlation between two asset classes rises sharply during volatile market environments, we do not consider these asset classes diversifying with respect to one another and adjust estimates accordingly. We aim to build robust strategies for our members that are resilient through adverse market events.

A glidepath designed to carry you to and through retirement

As seen in 2022, extreme market events can occur when a member is at the retirement phase of their journey, bringing with it the risk of running out of money too early. A strategy that targets a sustainable income to and through retirement can mitigate this by maintaining an exposure to growth assets post-retirement to help recoup any losses experienced.

Active risk management

De-risking members through retirement into an actively managed product can protect retirement income from extreme market volatility. Our SEI Moderate Fund is monitored by our investment and risk teams to determine if any de-risking actions are required. The strategic asset allocation is designed to minimise the need to de-risk. In extreme cases, the team has the ability to trade to prevent a maximum ‘peak-to-trough’ loss of 30%; however, this has not been required to date.

Get in touch with our experts if you’d like to find out more about our investment process and approach to glidepath implementation.

Important Information:

This is a Marketing Communication. This webpage has been created in relation to the SEI Master Trust, an occupational pension scheme which is authorised by the Pensions Regulator. The trustee of the SEI Master Trust is SEI Trustees Limited. SEI Trustees Limited has appointed SEI Investments (Europe) Ltd (“SIEL”) as investment adviser to the SEI Master Trust and pursuant to its investment advisory agreement. This information is issued and approved by SEI Investments (Europe) Ltd (“SIEL”) 1st Floor, Alphabeta, 14-18 Finsbury Square, London EC2A 1BR. This advert and its contents are directed at persons who have been categorised by SIEL as a Professional Client and is not for further distribution. SIEL is authorised and regulated by the Financial Conduct Authority. While considerable care has been taken to ensure the information contained within this webpage is accurate and up-to-date and complies with relevant legislation and regulations, no warranty is given and no representation is made as to the accuracy or completeness of any information and no liability is accepted for any errors or omissions in such information or any action taken on the basis of this information. The information in this webpage is for general information purposes only and does not constitute investment advice. You should read all the investment information and details on the funds before making investment choices. Please refer to our latest Prospectus (which includes information in relation to the use of derivatives and the risks associated with the use of derivative instruments), Key Investor Information Document, Summary of UCITS Shareholder rights (which includes a summary of the rights that shareholders of our funds have) and the latest Annual or Semi-Annual Reports for more information on our funds, which can be located at Fund Documents (https://seic.com/en-gb/fund-documents). And you should read the terms and conditions contained in the Prospectus (including the risk factors) before making any investment decision. If you are in any doubt about whether or how to invest, you should seek independent advice before making any decisions. The UCITS may be de-registered for sale in an EEA jurisdiction in accordance with the provisions of the UCITS Directive. Past Performance does not predict future returns. Investment in the range of the SEI Master Trust’s funds are intended as a long-term investment. The value of an investment and any income from it can go down as well as up. Investors may not get back the original amount invested. This document and its contents are for Institutional Investors only and not for further distribution. The SEI Strategic Portfolios are a series of the SEI Funds and may invest in a combination of other SEI and Third-Party Funds as well as in additional manager pools based on asset classes. These manager pools are pools of assets from the respective Strategic Portfolio separately managed by Portfolio Managers which are monitored by SEI. One cannot directly invest in these manager pools.