Commentary

2023 investment outlook

SEI's investment experts weigh in on the market themes that will matter to UK institutional investors this year.

2023 investment outlook

Key takeaways

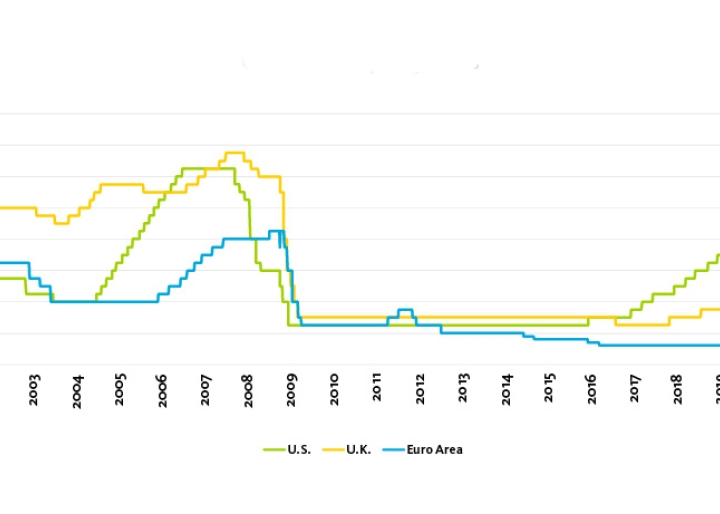

- We believe a short and shallow recession is likely this year, with the UK and Europe in a worse position than the US.

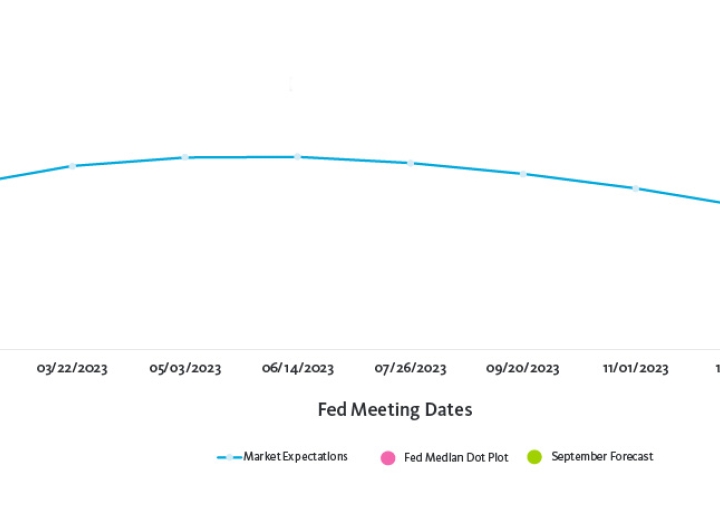

- We expect inflation will stay higher for longer – rates will have to move higher than markets expect.

- We see the now infamous UK mini-budget as having long-term consequences, signalling a shift for the industry, more stringent regulations around liability-driven investments (LDI), and a rethink of how to construct LDI strategies moving forward.

For Institutional Investors only. Not suitable for further distribution.

What does this mean for our positioning in 2023?

If, as our outlook suggests, a global recession looks likely, then how are our portfolio managers grappling with this prospect? The following section canvases opinion from across the SEI investment floor—our portfolio managers consider the macro environment and use this to inform their active positioning:

Jason Collins, Head of Global Equity

'Tentative signs of optimism have emerged in recent weeks, although we remain cautious in our equity market outlook. The pace of rate rises is slowing, and there are signs that inflation—whilst likely to remain above the 2% target for some time—is peaking. Further rate rises from here are likely, but this modest improvement in the macroeconomic outlook is supportive of equities.

Fundamentally, the macro backdrop is challenged and the risk of recession looms—although earnings growth remains positive, the pace of growth is slowing rapidly and will deteriorate further if recession does take hold. That said, we feel that much of the bad news is already priced in, and that the end of COVID-19 restrictions in China will lead to a rebound in demand that will boost growth—at least for firms exposed to emerging markets and China.

Although much of the speculative froth has been blown off, the US market continues to look relatively expensive; emerging markets, pulled down by China’s troubles and capital outflows into higher yielding US treasuries, we believe offer the most attractive valuations. Strategically, we maintain our focus on value, momentum and quality “alpha sources”. Value remains particularly attractive, despite recent outperformance, as valuation dispersions are still very elevated and the style has positive momentum. We expect the derating/rotation out of growth stocks to continue as the era of free money has ended.’

Anthony Karaminas, Head of Global Fixed Income

‘We’re likely to see elevated fixed income volatility, which provides a fertile hunting ground for active management in 2023. We don’t yet see any indications that the Fed will cut interest rates, but markets are pricing in an expectation of a rate cut at the back end of the year—so clearly there are disparate views taking place. We believe any recession will be short and shallow, and whilst credit spreads have widened, we remain cautious, as we believe the market will continue to price in recession risk.

That said, on the margin we’ve been selectively adding to higher quality credit, such as investment grade bonds, and we have moved from under to overweight on mortgage-backed securities. We generally remain underweight rates exposure in developed markets, but overweight in some emerging markets. We want to be patient on the corporate bond risk premium, as we think there will likely be an attractive entry point this year.’

Chris Pettia, Head of Private Assets

‘2022 reflected a changed market environment for private equity, caused by several factors including higher interest rates, inflation, and economic uncertainty. On the traditional buyout side, we saw fewer deals getting done, as managers remained cautious about the future and the cost of financing deals given high interest rates. Whilst traditional buyouts have decreased, we are seeing an increase in the number of public to private transactions. The IPO window has been shut for most of 2022, and is apace with 2008 in terms of the number of private equity-backed companies exiting via an initial public offering (IPO). Companies that are recession resistant, with strong growth prospects, continue to trade at premium multiples.

As public financing decreases, private credit is expected to grow, with businesses seeking capital and investors benefiting from the floating-rate nature of these investments. Investment in sustainable energy and energy security should enhance infrastructure, whilst also providing a hedge against inflation. The real estate market is adjusting to changing tenant requirements and increased financing costs, resulting in varying returns around the world and between different property types.

Despite the current environment, we still believe the long-term benefits of private asset investing outweigh the medium-term challenges. It is times like these when it is important to remember the importance of commitment pacing and diversification across multiple vintage years.’

Questions?

Understanding what the above means for your investment portfolio can feel like a daunting task. Fortunately, our team is on hand to help. Get in touch with your client director for more information.

Important Information

This is a Marketing Communication. This webpage contains marketing material about our fiduciary management service. This webpage does not represent impartial advice on this service. In certain cases, you are required to conduct a competitive tender process prior to appointing a fiduciary manager. Guidance on running a tender process is available from the Pensions Regulator.

This webpage is issued and approved by SEI Investments (Europe) Ltd (“SIEL”) 1st Floor, Alphabeta, 14-18 Finsbury Square, London EC2A 1BR. This webpage and its contents are directed only at persons who have been categorised by SIEL as a Professional Client, for the purposes of the FCA Conduct of Business Sourcebook. SIEL is authorised and regulated by the Financial Conduct Authority.

SEI Investments (Europe) Ltd ("SIEL") is the distributor of the SEI Irish UCITS Funds (“Funds”) and also serves an investment manager and/or fiduciary manager for clients who invest all or a portion of their assets in such Funds. SIEL provides the distribution and placing agency services to the Funds by appointment from its associate, the manager of the Funds, namely SEI Investments Global, Limited, a company incorporated in Ireland (“Manager”). The Manager has in turn appointed another associate, as investment adviser to the Funds, namely SEI Investments Management Corporation ("SIMC"), a US corporation organised under the laws of Delaware and overseen by the US federal securities regulator. SIMC provides investment management and advisory services to the Funds. Any reference in this webpage to any SEI Funds should not be construed as a recommendation to buy or sell these securities or to engage in any related investment management services. Recipients of this information who intend to apply for shares in any SEI Fund are reminded that any such application must be made solely on the basis of the information contained in the Prospectus (which includes a schedule of fees and charges and maximum commission available).Commissions and incentives may be paid and if so, would be included in the overall costs. Please refer to our latest Prospectus (which includes information in relation to the use of derivatives and the risks associated with the use of derivative instruments), Key Investor Information Document, Summary of UCITS Shareholder rights (which includes a summary of the rights that shareholders of our funds have) and the latest Annual or Semi-Annual Reports for more information on our funds, which can be located at Fund Documents (https://seic.com/en-gb/fund-documents). And you should read the terms and conditions contained in the Prospectus (including the risk factors) before making any investment decision. The UCITS may be de-registered for sale in an EEA jurisdiction in accordance with the provisions of the UCITS Directive.

The portfolio allocation may include exposure to Irish Common Contractual Funds (“Irish CCFs”) which are authorised by the Central Bank of Ireland pursuant to the Investment Funds, Companies and Miscellaneous Provisions Act 2005 and the European Union (Alternative Investment Funds Managers) Regulations (as amended) (the “AIFM Regulations”). The Irish CCFs are managed by SEI Investments Global, Limited an Irish private limited liability company which is authorized by the CBI pursuant to the AIFM Regulations. The Irish CCFs are subject to the Central Bank of Ireland’s regulatory regime for alternative investment funds contained in the AIF Rulebook and qualify as qualifying investors scheme for the purpose of the AIF Rulebook. As such, the Irish CCFs may be marketed solely to Qualifying Investors. SEI Investments (Europe) Ltd acts as the distributor of the Irish CCFs.

The portfolio allocation may include exposure to non-EEA Alternative Investment Funds managed by SEI Investments Management Corporation (“SIMC”) which may not be subject to the AIFM Regulations or equivalent legislation or regulatory oversight in those particular jurisdictions.

SEI Alternative Investment Funds may be non-standardised and bespoke, and may invest in a variety of underlying assets such as shares in unregulated collective investment schemes which do not provide a level of investor protection equivalent to collective investment schemes, debt securities including collateralized loan instruments, asset backed securities and other forms of structured credit, property, commodities or fund-of funds mutual funds. Alternative Investment Funds by their nature involve a substantial degree of risk, including limited liquidity, lack of regulatory oversight, tax risks, investment risks, risks inherent to investments in highly volatile markets, risks related to international investment, risks pertaining to various investment techniques that may be employed by the fund, risks related to the ability to diversify investments, risks related to the accuracy of valuations of investments, and conflicts of interest and the risk of complete loss of capital and are only appropriate for parties who can bear that high degree of risk and the highly illiquid nature of an investment.

SEI Alternative Investment Funds often engage in leveraging and other speculative investment practices that may increase the risk of investment loss. It should be noted that they may not be required to provide periodic pricing or valuation information to investors and may involve complex tax structures and delays in distributing important tax information, are not subject to the same regulatory requirements as SEI’s range of UCITS or the Irish CCFs, and may often charge higher fees and offer limited liquidity.

While considerable care has been taken to ensure the information contained within this webpage is accurate and up-to-date and complies with relevant legislation and regulations, no warranty is given and no representation is made as to the accuracy or completeness of any information and no liability is accepted for any errors or omissions in such information or any action taken on the basis of this information. You should read all the investment information and details on the funds before making investment choices. If you are in any doubt about whether or how to invest, you should seek independent advice before making any decisions. Past performance does not predict future returns. Investments in SEI funds are generally medium to long-term investments. The value of an investment and any income from it can go down as well as up. Investors may not get back the original amount invested.